Content

In fact, we can even fill out and file your expat tax return on your behalf.Contact us, and we’d be happy to help you. However, the concept of effectively connected income is incredibly complex. We recommend always consulting an expat tax specialist when determining whether you must file this form. With so many forms to keep in mind, looking ahead to what you might need for your business’ annual tax filings can save a last minute scramble. Filing taxes can be a complicated process, but having a better understanding of the forms your business needs to file can ease the stress of tax time. When you use TurboTax Home & Business or TurboTax Business , you just need to answer simple questions about your business income and expenses, and we’ll fill in all the right forms for you. TurboTax works with programs like QuickBooks and Quicken, so you can import information directly into your tax return.

What is Form 1120 Schedule M 1?

Schedule M-1 reports the taxpayer's current year net income and expenses as they are or would be shown on U.S. Form 1120, lines 1 through 28, in calculating gross income under the provisions of the U.S. IRC and the deductions allowable in calculating net income under the code .

If the due date for Do I Have To File Form 1120? a tax return falls on a Saturday, Sunday, or legal holiday, the due date is moved to the next business day. This means that if April 15 falls on a weekend or legal holiday, the due date for filing the tax return would be the next business day. Recently, a combination of Emancipation day, a holiday in Washington DC, where the IRS is headquartered, and the 15th falling on a weekend, have pushed out the Form 1120 due date. As of 2018, qualifying Shareholders in an S Corp are also eligible to deduct up to 20% of their net business income from their income taxes. You may be eligible for tax credits you didn’t even know about. For the IRS to accept Form 1120-S, it must be signed and dated by either the president or another corporate officer authorized to sign tax returns.

S Corporation Passive Income Restrictions

The biggest disadvantage of filing a Form 1120 is that it is separate from your personal income tax return. For example, S corporations do not need to file Form 1120. S corporations are classified by the IRS as corporations that pass their corporate income through to shareholders . The shareholders then report this income or loss on their personal tax returns. Here’s where you calculate your C corporation’s tax liability.

- They include Form for foreign operations of U.S. corporations and Form for capital gains and losses.

- Corporations with fewer than 100 shareholders may choose to form an S corporation for the purposes of avoiding double federal taxation.

- Corporations only use this form if the company has already filed IRS Form 2553and the IRS has approved S Corp election for the company.

- There are many different categories of foreign corporations that may have to file the form — although are various exceptions, exclusions, and limitations for filing.

- You’ll have blanks for cost of goods sold, depreciation, gains and losses, tax credits, and all total lines.

Corporations must file an income tax return with the Internal Revenue Service each year, even if the corporation did not have any transactions. This rule applies to regular corporations – also called C corporations – and Subchapter S corporations. Tax-exempt entities should review Form 990 instructions to determine filing requirements in years when no business is transacted. Schedule C is a simple way for filing business taxes since it is only two pages long.

When is Form 1120 due?

You’ll need to mention the accounting method used and a description of your business service or product. On Schedule-K, you’ll report the shareholders deductions, credits and income. Some corporations may be required to fill out Schedule L, which is a balance sheet. If you file Schedule L, you’ll also need to submit Schedule M-1. Schedule M-1 reconciles the business’s profits and losses from the accounting books with the tax return. Schedule M-2 is another tax form that’s short but complex. It essentially tells you how much money you have leftover after the profit and losses, or your business’s balance.

Even if you’ve missed the window for making the initial election, you can still file an 1120S and include your Form 2553 with your initial return, along with an explanation of why it was late. It may be beneficial to file the S-election for 2017 to possibly enable the shareholders to take taxable losses on their personal returns for 2017. If you are still within the filing window for making your initial S-election, you should complete Form 2553 (the form used to make the S-election) and file it with the IRS for your 2017 tax year. Form 2553 must be filed within two months and 15 days after the first day of your 2017 tax year. A corporation must file a tax return for every year of its existence.

Overview: What is Form 1120?

A general partnership is an arrangement in which two or more persons agree to share in all assets, profits, and liabilities of a business. A shareholder is any person, company, or institution that owns at least one share in a company. Cost of doing business, such as the expenditure on goods that you used to create products that your business sells. Canceled or forgiven non-shareholder business debt, if you have any.

- If your foreign corporation will owe any taxes on your Form 1120-F tax return, you are still required to pay that debt by the original deadline.

- Cost of doing business, such as the expenditure on goods that you used to create products that your business sells.

- If “Yes,” file Form 5452, Corporate Report of Nondividend Distributions.

- Its only U.S. source income is exempt from U.S. taxation under section 881 or .

- Filers of Schedule M-3 , Net Income Reconciliation for Corporations With Total Assets of $10 Million or More, use this schedule to provide answers to additional questions.

As https://ojas-gpsc.com/levitra-genericky-informacie-o-produkte/ a brief recap, a corporation or C Corp is a type of business structure that is a separate legal entity from its owners. Corporation owners, or shareholders, are not personally liable for the business’s debts and actions. As a business owner, you have so many responsibilities, yet so little time. You need to handle your business’s books, manage day-to-day business operations, and keep your business on track for success. In addition to your countless other tasks, you need to file a small business tax return. This article is for educational purposes and does not constitute legal, financial, or tax advice.

ALL SERVICES

Once you’ve https://intuit-payroll.org/d Form 1120, you should have an idea of how much your corporation needs to pay in taxes. But that money doesn’t go to the IRS all in one lump sum; every corporation is required to pay quarterly estimated taxes. The IRS has a full list of tax-exempt organizations here. These types of organizations must file an information return that should include Form 990, Form 990-EZ and Form 990-PF. Download these tax forms and their instructions on the IRS website.

2022 Tax Filings: Updates and Reminders for Alternative Investment … – Marcum LLP

2022 Tax Filings: Updates and Reminders for Alternative Investment ….

Posted: Wed, 08 Feb 2023 08:00:00 GMT [source]

Scans for every possible tax deduction & eliminates 95% of your work, and provides you with the most accurate tax amount. Tax service for freelancers, it is easy to set up and absolutely free effortless to use. Finds every tax deduction, eliminating 95% of your work, and provides you with the most accurate tax amount.

More In Forms and Instructions

Different types of business entities can require a different set of tax forms for reporting your business income and expenses. Regardless of the form you use, you generally calculate your taxable business income in similar ways. Start the filing process by gathering your tax team, which should include a corporate tax professional and corporate tax filing software. C corporations use Form 1120 to file their business taxes. Follow these six steps to properly complete and file Form 1120 by the due date . A C corporation is a company whose owners or shareholders are taxed separately from the corporation itself, and whose profits are taxed on both a business and a personal level. Corporations with fewer than 100 shareholders may choose to form an S corporation for the purposes of avoiding double federal taxation.

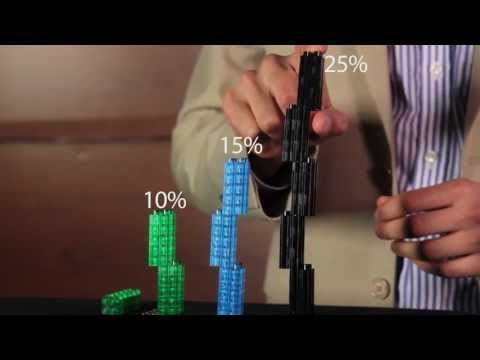

Line 2, “income tax,” is where you multiply your taxable income — page 1, line by the 21% federal corporate tax rate. Of course, the calculation isn’t always so simple, so you and your tax professional should check the Form 1120 instructions for exceptions and further details. C corporations, or c corps, are considered separate entities to their owners ; therefore, owners do not include the corporation’s income tax as part of their personal tax return.